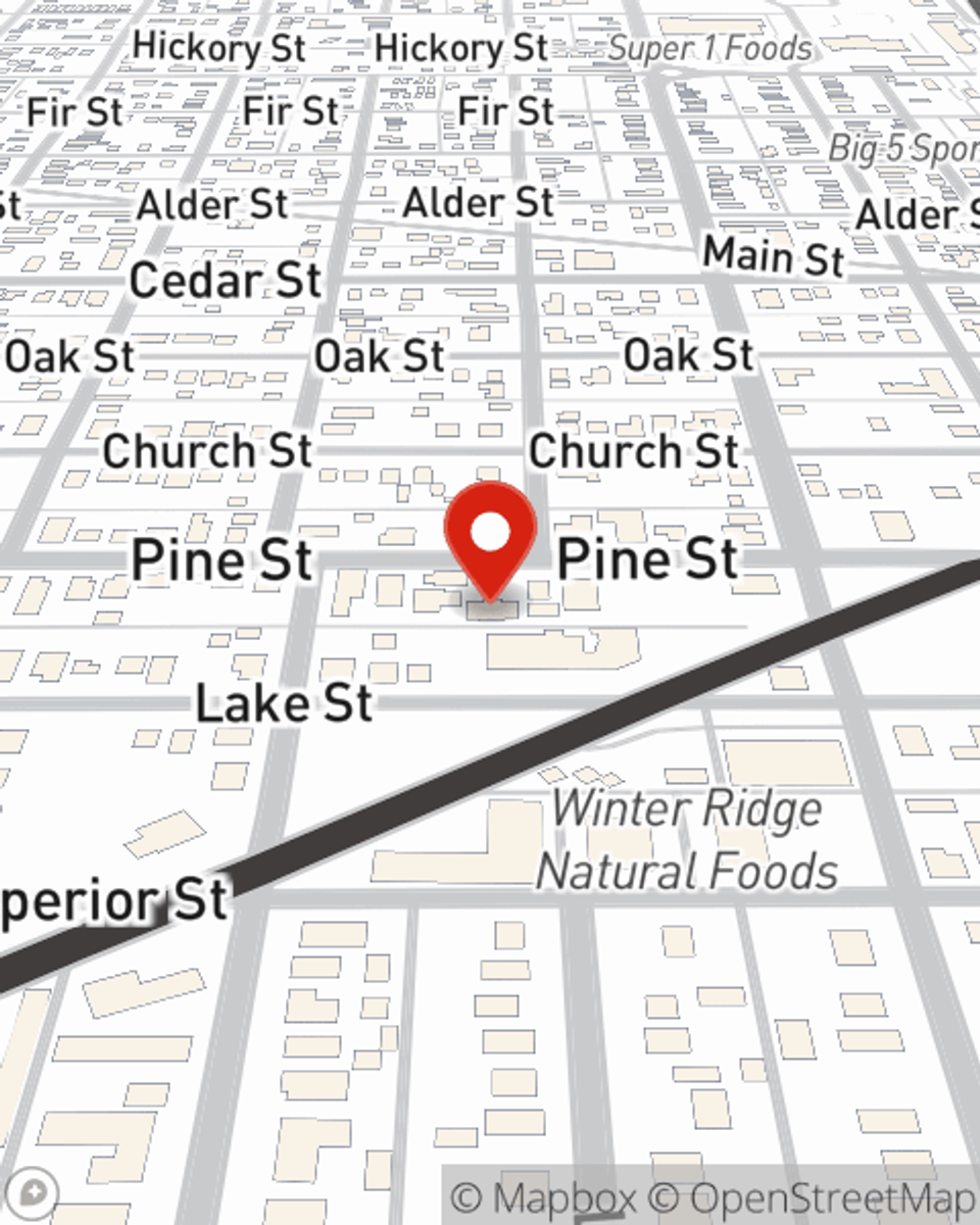

Condo Insurance in and around Sandpoint

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

- Idaho

- Sandpoint

- Sagle

- Ponderay

- Kootenai

- Hope

- Priest River

- Hayden

- Coeur d'Alene

- Bonners Ferry

- Cocolalla

- Post Falls

- Dover

- Priest Lake

- Careywood

- Athol

- Washington

- Naples

- Newport

- Spokane

- Montana

- Kalispell

- Libby

- Thompson Falls

Welcome Home, Condo Owners

Life happens.. Whether damage from weight of snow, theft, or other causes, State Farm has dependable options to help you protect your condo and personal property inside against unexpected circumstances.

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Put Those Worries To Rest

You can relax with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with terrific coverage that's right for you. State Farm agent Marcus Mabrey can help you discover all the options, from bundling, a Personal Price Plan® to liability.

Great coverage like this is why Sandpoint condo unitowners choose State Farm insurance. State Farm Agent Marcus Mabrey can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Marcus Mabrey can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Marcus at (208) 265-7755 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Marcus Mabrey

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.